-by Lemuel J. Lim, LL.B.(Hons)(UK), LL.M. (UK), LL.M Tax (US).

What is the main way to value a small business? Strictly speaking, it depends on the nature of your business. However, for many small businesses, the most commonly used method is to look at earnings. This article gives a simple explanation on how to perform the earnings method, sometimes called an earnings comparison, the business multiplier method, or a host of similar names.

It is also the third part in a series on how to value a small business. The first article in the series provides an overview of which valuation methods to use in different contexts.

I. Business Multiplier: Valuing Your Business By Comparing Earnings

An earnings comparison is the most commonly used method of valuation. The concept is quite simple. An earnings valuation essentially involves just four steps:

Step 1: find the business’s annual net earnings (its income after expenses);

Step 2: calculate the average for the last few years;

Step 3: Find the “business multiplier.” Your average earnings (in Step 2 above) is multiplied with this “business multiplier”;

Step 4: adjust the multiplier to make it specific to the target business.

II. Earnings Comparison – Step-by-Step Guide

Step 1: Calculating Annual Net Earnings

A business’s annual net earnings are the “real” profits of the business. In other words, what the owner could spend on him or herself, or reinvest in the business, at the owner’s discretion.

For most small businesses, the earnings calculation commonly used is called “SDE” (“Seller’s Discretionary Earnings”). For larger businesses, the calculation is called EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). They’re largely the same, but SDE (the version for small businesses) assumes the buyer will receive the seller’s salary and benefits. This is because most small business owners pay themselves a salary and benefits (as opposed to owner distributions) that are a large portion of the business’s net earnings. For businesses where executives or managers run the business for the owner(s), and the owner(s) receives relatively little or no income as salary and benefits, EBITDA is fine. This article explains SDE, because this is more relevant for smaller businesses.

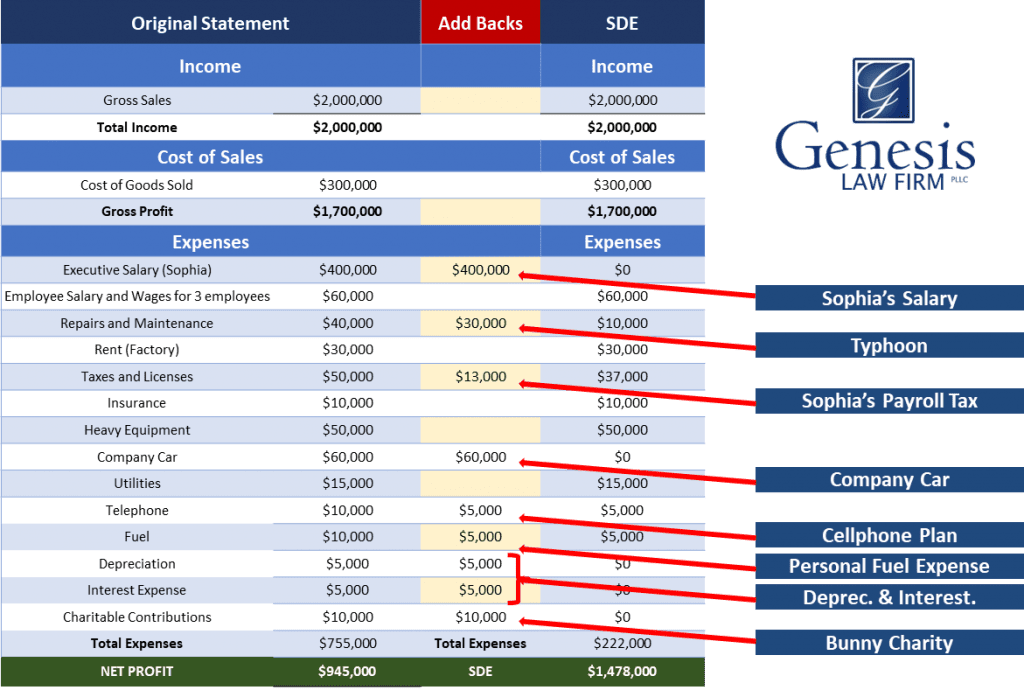

To calculate SDE, look at the profit and loss statement (P&L), or the management accounts of the business. Sometimes the information from a business tax return can be used to understand the net profits, or the tax return is used to corroborate the accounts.

Always start by keeping in mind the objective of SDE, which is to show the true benefit the business provides to the owner. We do this by taking the net profits of the business and adding back any expenses that are considered discretionary for the owner (because they benefit the owner, or because they do not benefit the business or its employees). You should also add back any expenses that the buyer would not be responsible for after they purchase the business.

Add backs come in two different flavors. Firstly, there are “standard” add backs which are almost always included if they are relevant. Secondly, there are “situational” add backs that are added to achieve the goal of showing the true benefit. Situational add backs are situational expenses that are unique to the business, but if they were not added back, it would not paint the true benefit to the owner. Standard add backs are commonly recognized expenses that almost always must be accounted for when calculating SDE.

Here are some of the most common standard add backs:

- The owner’s salary, dividend payments, and other compensation packages paid to the owner. You should also include any excessive salaries for family members, the cost of a company vehicle for the owner, or trips to Hawaii for supposed business meetings etc. The new owner can cut most of these expenses out without hurting the business’s production. Note that you can only add back one owner. If there are multiple owners, you can only add back one owner’s compensation package LESS the salary of any employees needed to replace the other owners.

- Interest Expenses. Interest expense

is not included because business debt is a “non-operating expense” and is

assumed to be paid off on sale.

- Payroll Taxes. Since we are adding

back the owner’s salary package, we also have to add back the company’s share

of the owner’s payroll tax.

- Depreciation and Amortization. A

business can depreciate certain tangible assets and amortize intangible assets every

year as an “expense”, but this expense is just on paper and has little or no

impact on how much money the owner is able to spend. You don’t necessarily need

to understand this, just add back the line items under “depreciation” or

“amortization.”

- Health Insurance. If the owner is

running personal health insurance through the business, add that back as part

of the future owner’s potential benefit.

- Charitable Contributions. So long as

the charitable contribution is not necessary for the production of revenue,

this should be added back.

- Fuel. If a company vehicle is being

used by the owner for personal reasons, you can add back some of the estimated

yearly fuel expenses for personal use.

- Extraordinary, Uncommon, or Non-recurring

Expenses. For example, expenses from a rare lawsuit unconnected to the

production or service of the business, flood damage, fees for lawyers (and

other advisors) involved in selling the business, and expenses for discontinued

products. You should also subtract from the income

section, any non-recurring income,

such as from the sale of a large asset or revenue from a discontinued product.

Whether something is non-recurring is a little subjective. The seller is going

to want to say that more things are non-recurring because that increases

valuation. The buyer, on the other hand, is going to want to say that less

things are recurring because that lowers the valuation. This is one the things

that creates space for negotiation.

Let’s look at an example to drive the point home:

Example: Sophia is the sole owner of Exodus, Inc. and wants to sell her business. Exodus makes plastic unicorn toys and is located in Everett, WA. The calendar year for the corporation is almost over and this present year, Exodus generated $2,000,000 in gross revenue. Sophia takes a salary of $400,000 per year and works full-time at Exodus. Earlier this year, a freak typhoon hit the Exodus factory and caused $30,000 of damage to factory equipment. Exodus pays for Sophia’s cellphone plan, and Sophia has allowed her son Eli, and daughter, Anna, to be additional members of this cellphone plan. The cost to Exodus of this plan is $5,000. Exodus also provides Sophia with a company car, and Sophia regularly uses the car to ferry her children to and from school and soccer practice. She also uses the company car to do her grocery trips at the nearby organic supermarket. She has racked up $5,000 in personal fuel expenses doing all these personal errands. Sophia loves Bunny Care, a registered charity that looks after runaway bunnies. This year, she has directed Exodus to donate $10,000 towards this charity. Calculate her SDE for this year.

Step 2: Calculate the Average for the Last Few Years

Sometimes the business’s profitability and expenses fluctuate extensively from year to year. If the trend is steadily upward, use the most recent numbers. If the numbers go up and down, you can average several years, such as the last three or five years. If there are multi-year cyclical trends in the business, then the average of at least one multi-year cycle should be taken.

Step 3: Work out the Business Multiplier

Now that you’ve calculated the average SDE, it’s time to determine the business multiplier.

So what is a multiplier? And why do we need to multiply the SDE by this number? The basic principle here is that potential buyers would not want to pay more for a business than what they would spend for a similar business that is publicly listed, or even a private business that was recently sold. It is similar to how we do appraisals for residential property purchases. If I want to move into a new neighborhood, and I know that the Jones family next door paid $300,000 last year for a similar house, I am not going to pay $600,000 for my targeted house. Instead, I will tell the seller of the house I am interested in to “get real” and refer them to the prices that have been paid in the surrounding area.

SDE multiples are the same. They “even out” and give a point of comparison for similar businesses in the same area. If a similar business is trading at 3 times their earnings, then a prospective buyer would generally expect that the target business should also sell for 3 times their earnings. If the seller wants more, the prospective buyer would want to know the reasons that justify this higher demand.

The problem is getting this business multiple. Calculating a multiplier is where expert appraisers have a distinct advantage over a layperson’s appraisal. Why? Because they have built for themselves a database of historical information and metrics of past transactions to refer to. If you don’t want to hire a professional appraiser for a full valuation, you may be able to get professional help calculating your multiplier for a reduced rate.

It is still possible to try to do this yourself. However, it is important to note that in some situations or industry areas, the information necessary to make such a comparison may be too difficult or would yield unrealistic results. On the assumption it is possible to perform this comparison yourself, here is what to do:

- Research and identify related businesses in

the same industry sector as the target business. Look at company

websites of similar companies you know of. Go through their press releases,

recent activities section, and investor relations information they have

provided. Look at financial newspapers, local newspapers for news of recent local

mergers and acquisitions. Look at trade association and industry websites. Look

at publicly available research on the industry sector. You may also wish to

refer to paid sites such as thedeal.com. If you are willing to

expend money, you can sign up to purchase the latest Business Reference

Guide or subscribe to a Bloomberg terminal to have access to

Bloomberg CACS to see comparable companies (note: Bloomberg is expensive).

Finally, if the relevant local industry sector is small, or the business

community is tight knit, one way of finding out is simply to ask local business

leaders to see if they are willing to disclose this to you!

- Filter your list of companies to get the

most relevant. Look at important factors such as: (i) the time of the

transaction (should be very recent); (ii) similarity in revenues; (iii) the

type of business (most definitely in the same or similar industry area) but

specifically, look at products, services, target customers, etc. Finally, look

at the location.

- Calculate or estimate, as best you can, the

multiple of each similar business compared to their respective earnings.

Step 4: Adjust the Multiplier to make it Specific to the Target Business

Once a preliminary range has been determined. The business multiplier should be adjusted to meet the situation specific to the business. For example, if the business has some key advantage that makes their operations more productive, cheaper, or quicker, the multiple can potentially be adjusted upwards. Obviously, at the end of the day, the buyer must be able to comprehend these competitive advantages or upward adjustments would merely be wishful thinking on the part of the seller.

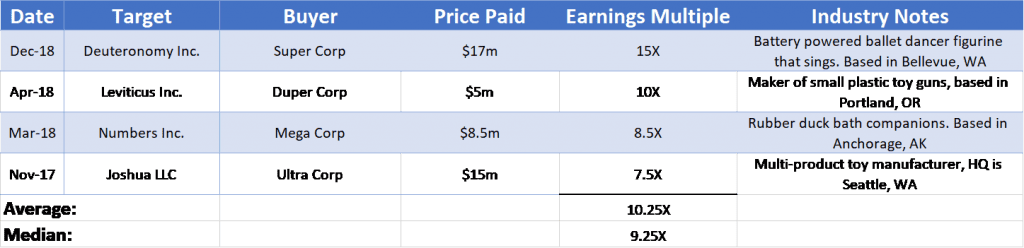

Let’s bring this all together with the same worked example:

Example: Sophia wants to make sure that she extracts as much as possible from the sale of Exodus and is prepared to do the work herself to save on costs. She researches similar businesses in the toy manufacturing industry, and creates a shortlist of the most relevant companies that were recently acquired. She calculates their approximate business multiples and gains the following results:

Sophia estimates that the rough multiplier for her business would be approximately 9.25X to 10.25X. Assuming her average SDE is $1,478,000, this would put her valuation at approx. $13,671,500 to $15,149,500 (SDE of $1,478,000 multiplied by 9.25 for lower range, and multiplied by 10.25 for higher range).

Not content even with the upper range of the multiple, she believes her business is worth more. Sophia knows she has a very impressive piece of manufacturing machinery that she designed and built herself. This machine allows her to make plastic unicorns very quickly and only requires 3 employees to maintain the manufacturing. It would take other manufacturers triple or quadruple the number of employees to maintain the same velocity of manufacturing.

Furthermore, these other manufacturers would need to pay each of their employees a much larger salary for the skills and qualifications to match the production rate of Sophia’s innovative machinery. Sophia puts together a bundle of documentary evidence and statistics to demonstrate this competitive advantage ready for negotiations with her prospective buyer. She believes that while her product is not as superior as Deuteronomy Inc.’s singing ballet dancer, the superiority of her manufacturing process should at least command an uplift to 11X. Sophia enters negotiations?

We hope you found this article helpful. Our firm believes in making quality information available online free of charge; and, in that vein, we’ve written on numerous related topics. We encourage you to visit our firm’s business resource page.