by Lemuel J. Lim at Genesis Law Firm, PLLC

When experts talk about “M&A structure,” what do they mean by that? In simple terms, M&A structure is the method that is used to acquire another business. It is one of the key follow-up questions after: “am I interested in buying this business?” and “how much is this business worth?” In this article, we explain as simply as possible the basic structures you may encounter when buying a business.

There are three basic structures we will cover here:

- Asset Acquisition: the buyer buys the assets of the business.

- Stock Purchase: the buyer buys the stock of the business.

- Merger: the buyer merges or “combines” with the business.

Each method has its own pros and cons. Let’s get started!

I. Asset Acquisition

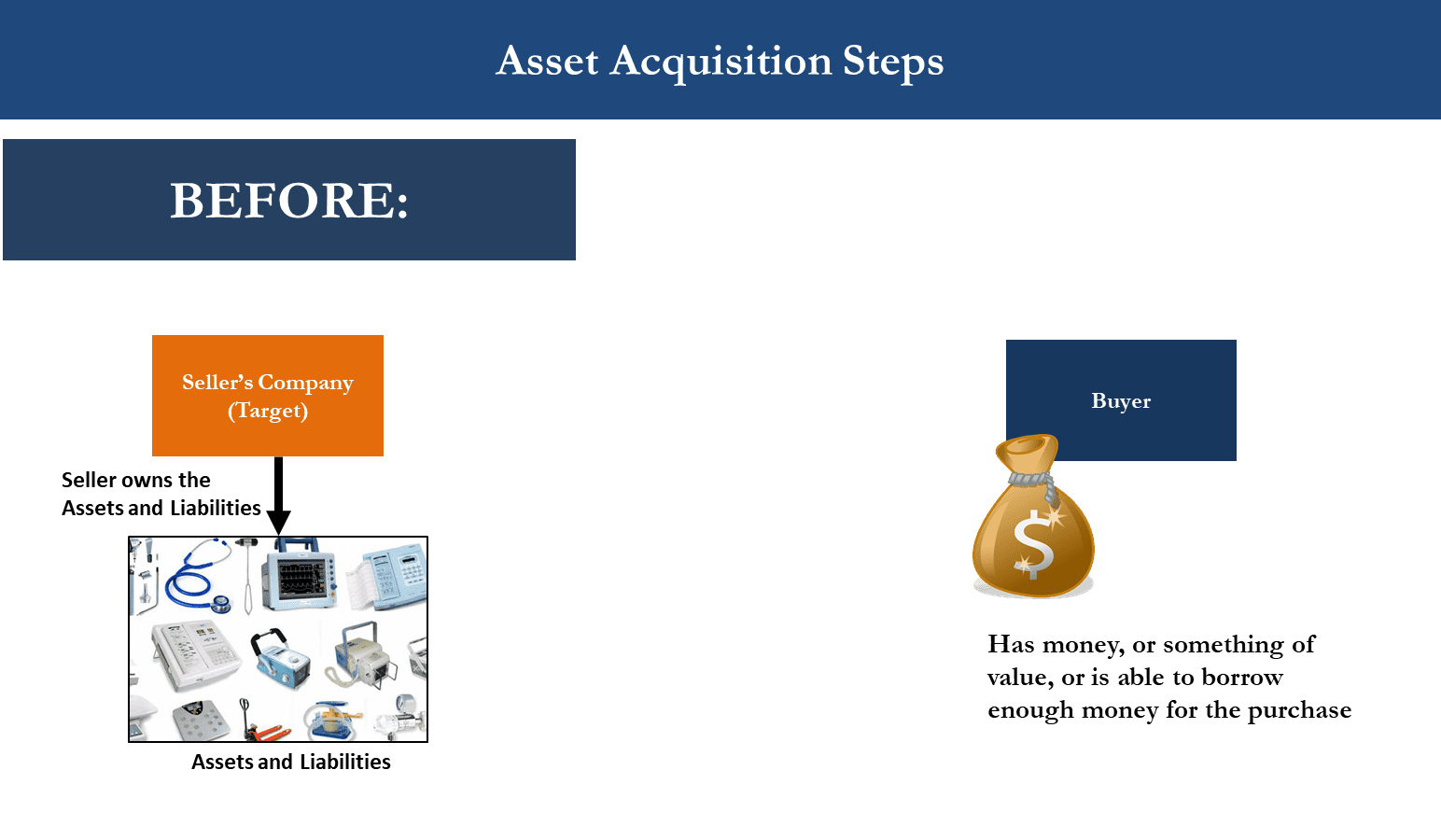

An asset acquisition is simple: the buyer agrees to buy from the seller the individual assets of the business. The “assets” the buyer may wish to buy can be anything from machinery, equipment, inventory, real estate property, contract rights, accounts receivables, intellectual property (e.g. trademarks, copyright, etc.), database of customers, and so on.

The buyer may also agree to take up certain specific liabilities of the business being sold. Liabilities can be anything from bank loans, debt that the seller took out to finance the purchase of certain assets, accounts payable, contract obligations, employment contracts, and so on.

An asset acquisition sounds simple enough, right? As a concept, yes – very simple! In practical reality? Not always that simple.

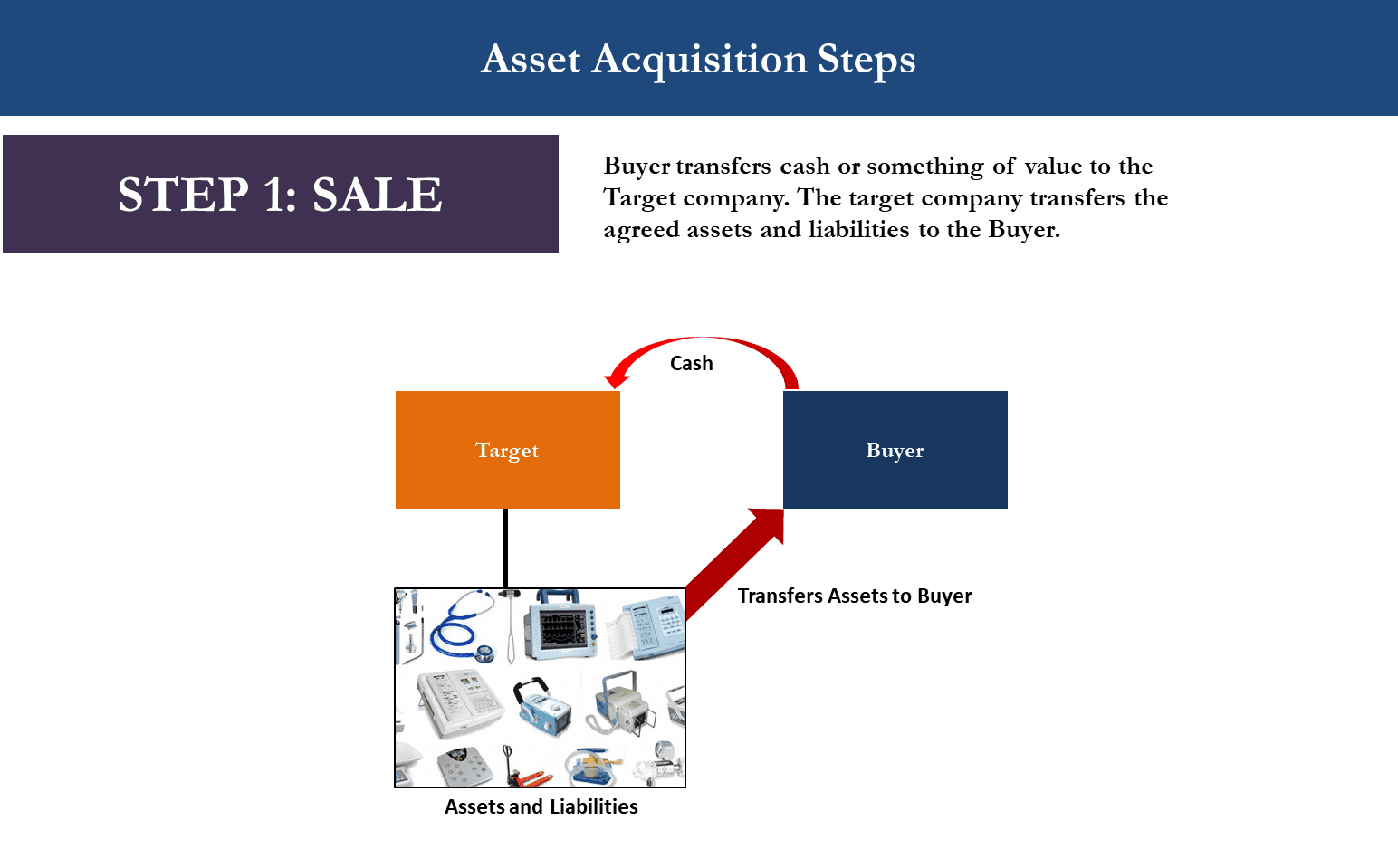

With this type of sale, the parties will have to specifically identify what assets the buyer intends to buy, and what liabilities the buyer intends to take up. This might end up being a mammoth task for both parties to identify and agree what specifically will be transferred and what will not. For some buyers, there may be worries that if certain assets are not transferred, this will hamper or delay the ability of the buyer to continue the operations of the business once the sale is completed.

There may also be the headache of satisfying the process of transferring assets. Some assets may require registration or recording in order to “properly” transfer those assets. Other assets might have debt tied with the asset (because the debt was used to finance the purchase of such assets). This may create third party rights and may require the parties to seek the permission of a third party (i.e. the lender) before the asset can be transferred.

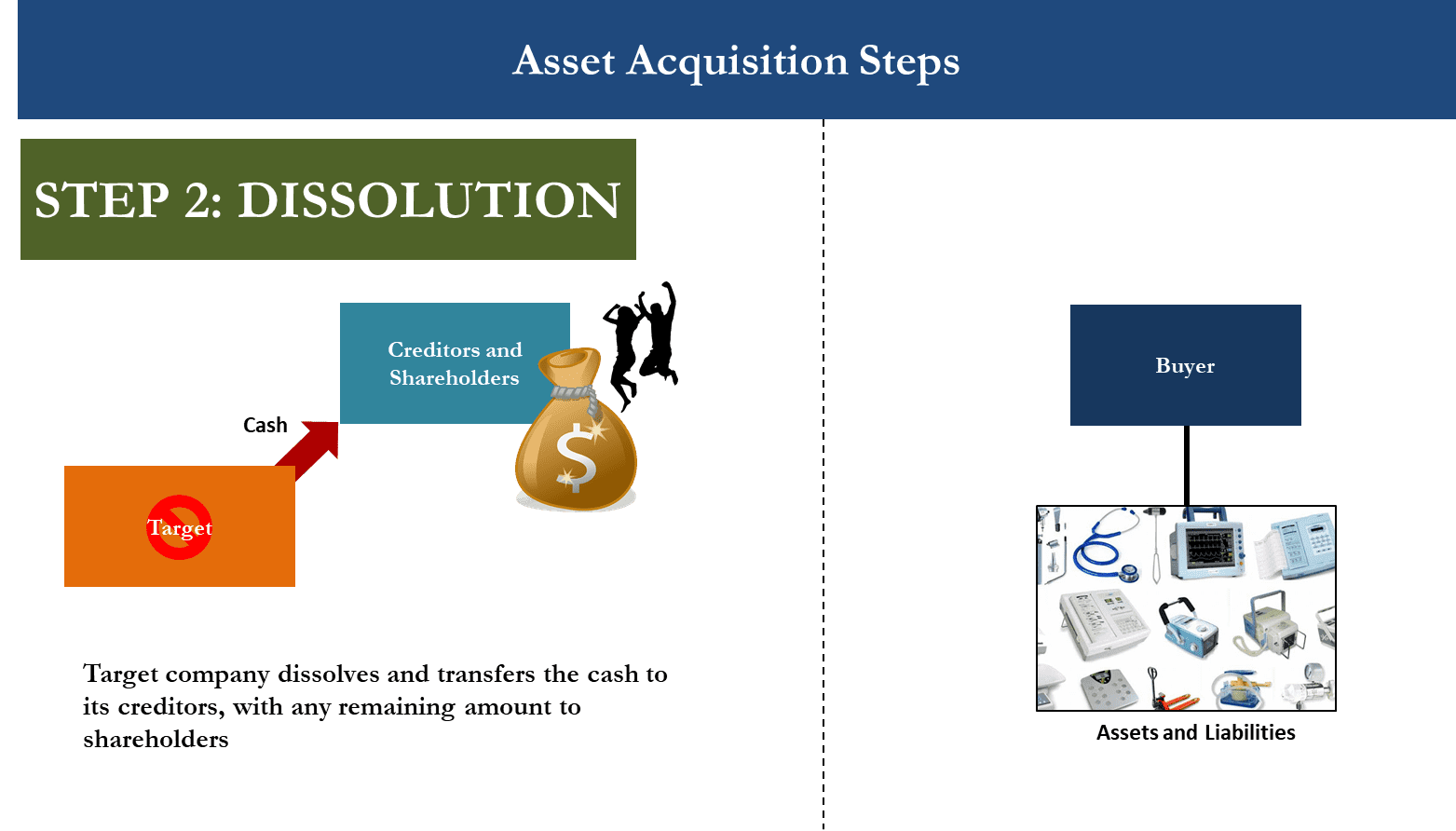

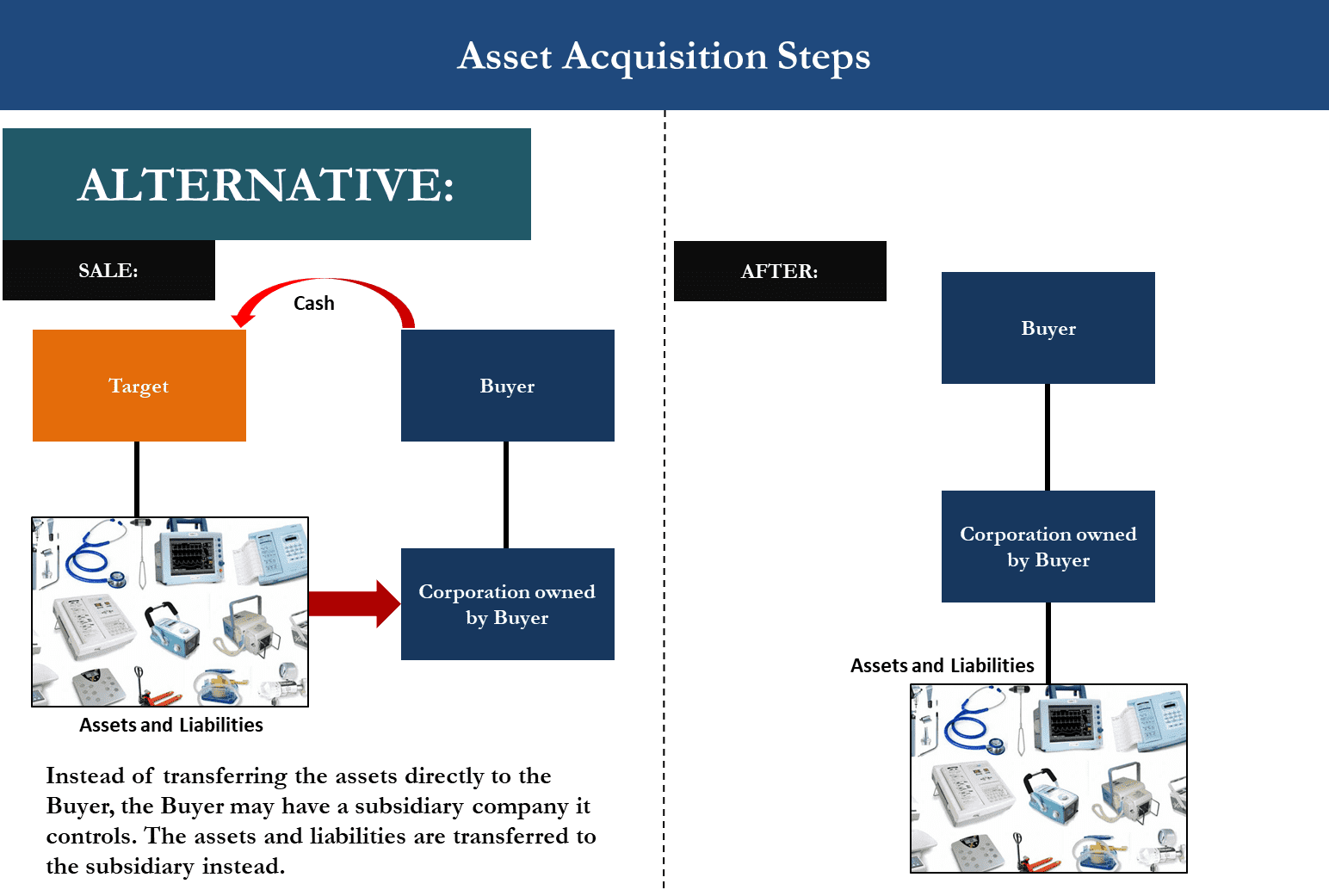

Let’s look at the below diagrams of an asset acquisition to drive home how it all works.

Advantages of an Asset Acquisition

Asset acquisitions are generally the preferred structure for buyers.

- Buyer Advantage – Avoid Unwanted Assets and Liabilities: Buyer can avoid buying unwanted or unneeded assets and avoid picking up certain liabilities. No liabilities are assumed unless specifically transferred under the documents.

- Buyer Advantage – Less Chance of Picking Up Unforeseen or Undisclosed Liabilities: Because the ownership of the company is not being transferred to the buyer, there is less chance that the buyer will pick up unforeseen or undisclosed liabilities that may be lurking in the target company.

- Buyer Advantage – Better Tax Treatment: Typically, but not always, the buyer will receive better tax treatment compared to a stock purchase. Buyers can receive a stepped-up cost basis in the acquired assets to reduce their taxable gain, or increase their deductible losses when they later sell.

Disadvantages of an Asset Acquisition

- Buyer Disadvantage – Failure to Buy Sufficient Assets: A buyer may fail to purchase all the assets they need to run the business they bought if they are not careful to identify all the assets that are needed in the purchase agreement.

- Buyer Disadvantage – Time Consuming and High Transaction Costs: Identifying all the assets that are to be transferred can be time consuming. It can also increase legal fees, accounting fees, advisory fees, and other transaction costs.

- Third Party Consent: There may be problems with the sale if some of the key assets to be transferred are subject to third party consent.

- Subject to Sales or Transfer Tax: Buyers can be subject to state-level sales or transfer taxes on some or all of the assets being purchased. Depending on state or foreign tax law (especially if the transaction involves a non-US element), sellers may be required to withhold a portion of the purchase money as withholding tax.

- Buyer Disadvantage – Seller Could Retain Enough Assets To Compete: If the purchase agreement does not contain a non-compete agreement or some other mechanism to restrain the seller from competing against the buyer, the Seller could retain enough assets to compete against the buyer.

- Seller Disadvantage – Seller Left With Unsatisfied Potential Liabilities: The seller could be left with potential liabilities without significant assets or cash from the asset sale to cover its potential liabilities. This is especially the case where the seller has contingent liabilities e.g. a pending court case with potential civil penalties.

- Seller Disadvantage – Less Favorable Tax Treatment: Less favorable tax treatment because of double taxation.

II. Stock Purchase

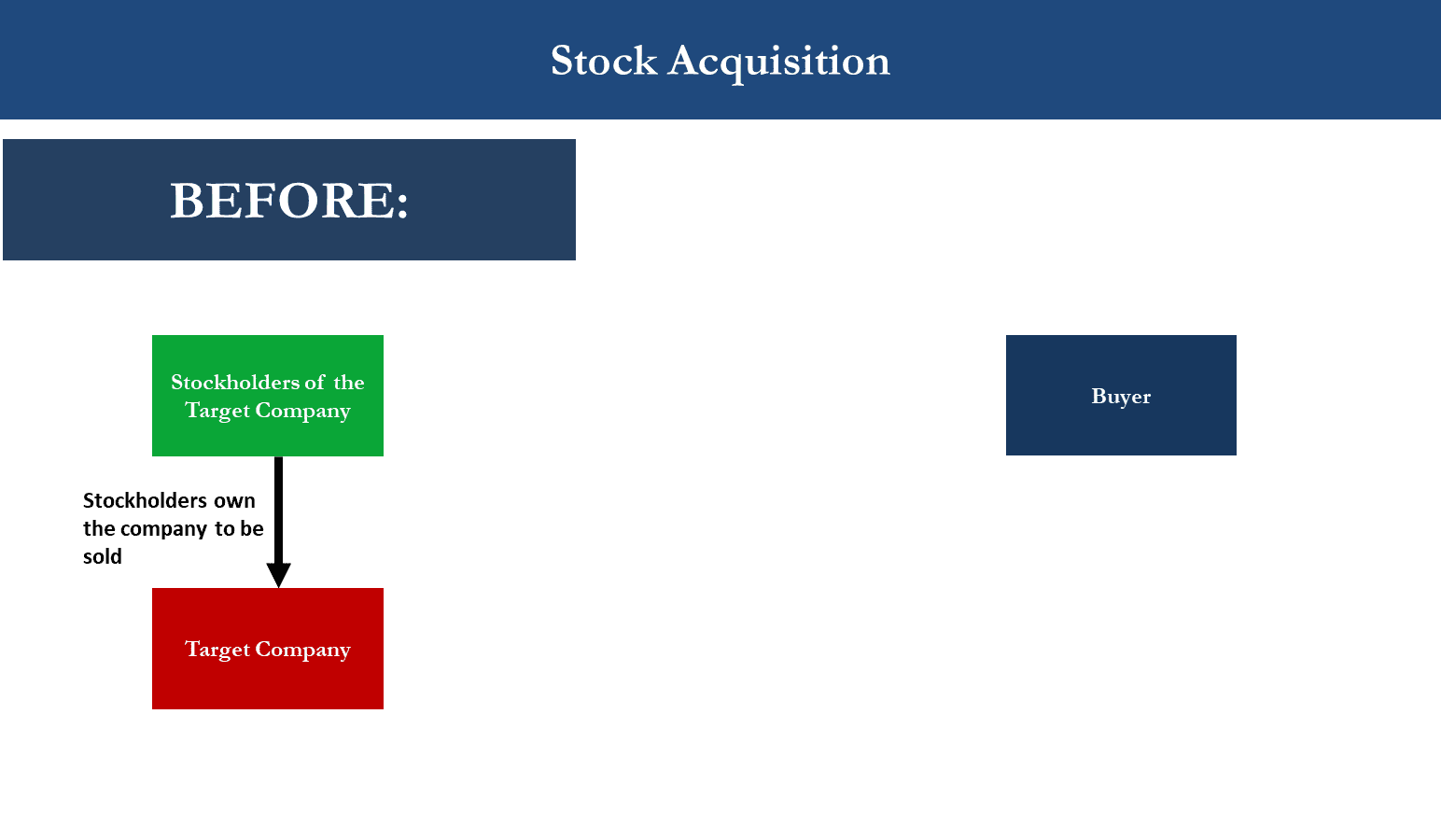

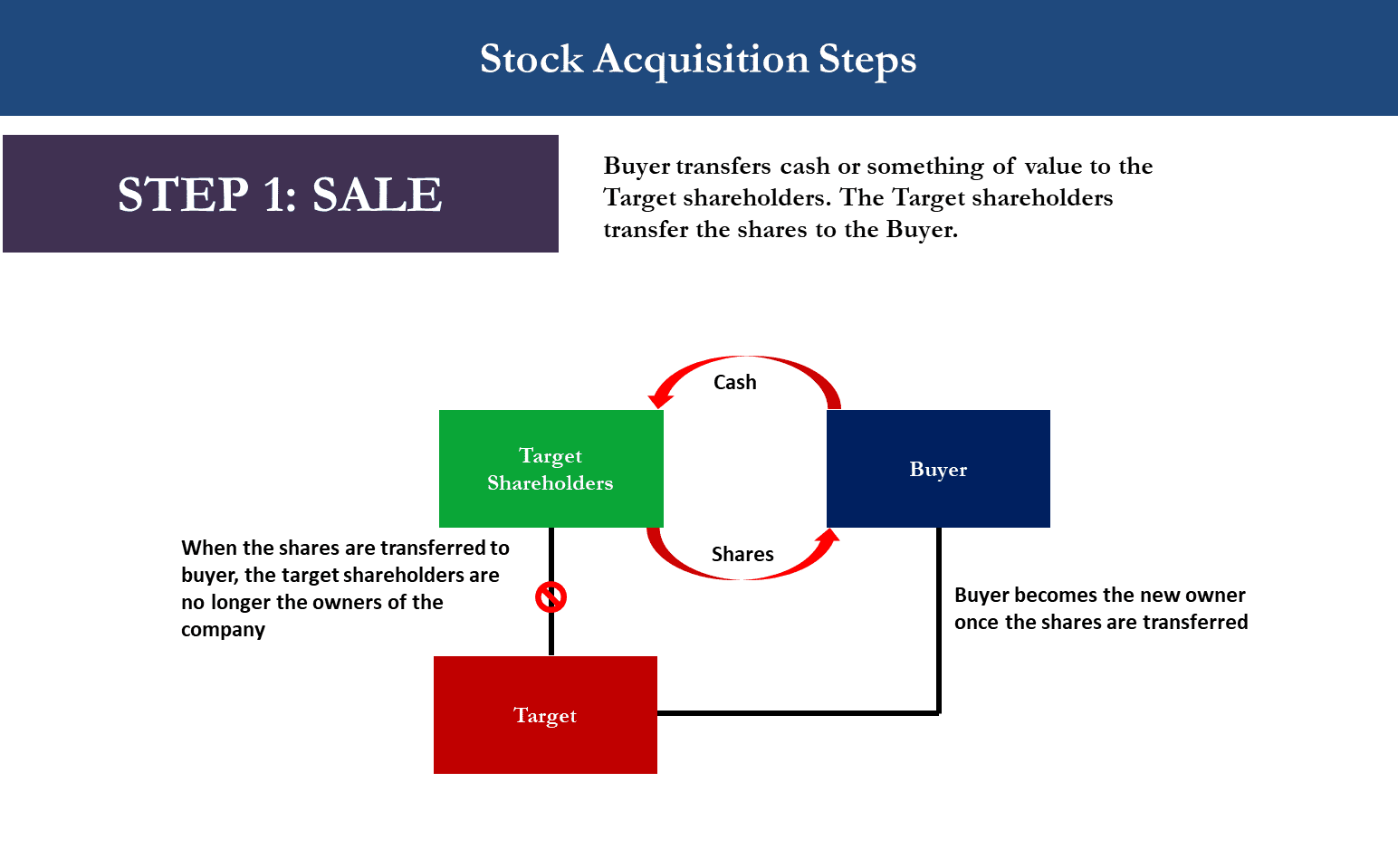

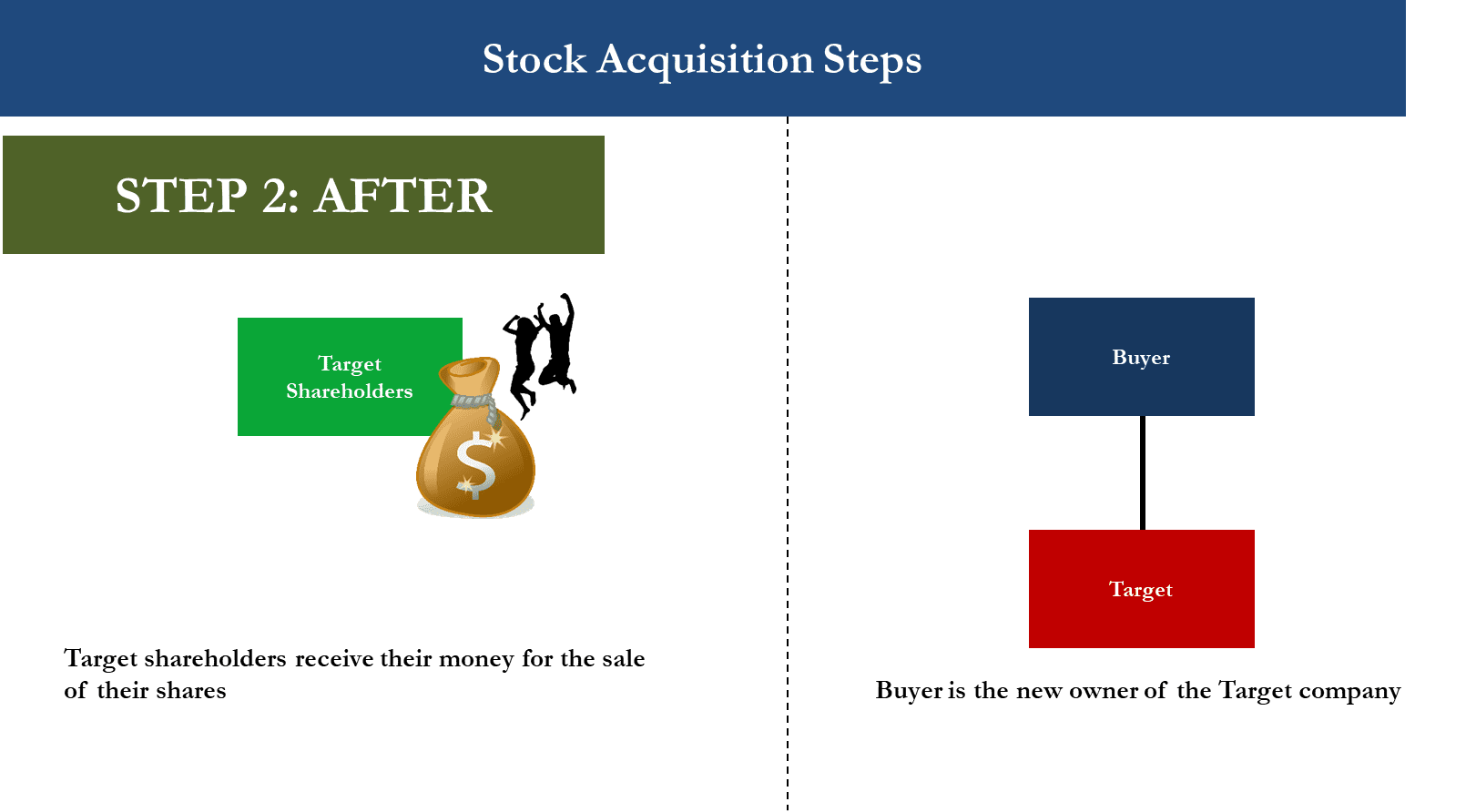

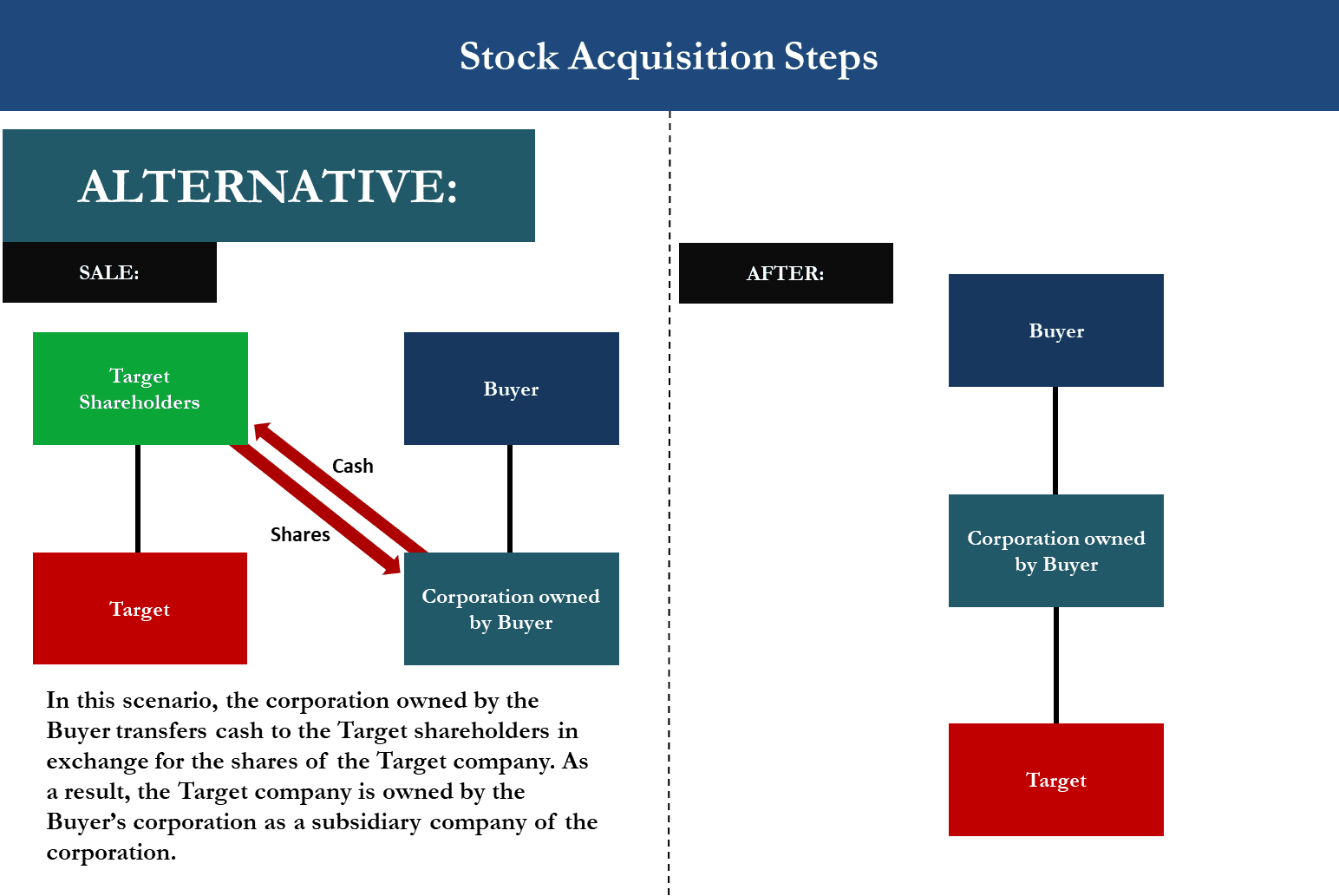

A stock acquisition does exactly what it says on the tin: the buyer agrees to buy the target company’s stock from the stockholders. It is often the easiest type of transaction to execute for small business transactions.

From a legal perspective, very little about the company changes except who now owns the company. This can be an advantage because virtually all the assets and contracts are under the name of the company so there is likely to be less consent from third parties needed to approve the transaction. It is therefore easier for the buyer to continue the operations of the business after the sale is consummated.

The ease of continuing the operations of the business after the sale also has a downside for the buyer. The buyer may have to be responsible for any unforeseen or undisclosed liabilities that were not disclosed or anticipated during the transaction process.

Things, may also get a little bit more complicated if the target company has a large number of stockholders. Not only is there an administrative burden of dealing with large numbers of shareholders, but things can also get complicated if there are different share classes as each class may feel discontentment at terms of the sale compared to other share classes.

The problem is exacerbated as the number of shareholders grow. The more shareholders there are, the more likely there will be shareholders who will not agree to the sale.

For most small to medium business transactions, this is likely not too much of a problem as most small to medium businesses are closely held companies with a smaller number of shareholders.

Let’s look at the below diagrams of a stock purchase to drive home how it all works.

Advantages of a Stock Acquisition

Stock acquisitions are generally the preferred structure for sellers.

- Buyer Advantage – Easier for Buyer to Carry on the Operations of the Target Company: Buyer can usually continue the business of the target company with relative ease.

- Consent from Third Parties Not Needed: There should be little to no third party consents required for the sale to execute. This is because the assets and liabilities remain under the name of the target company i.e. there is no change of ownership of assets and liabilities.

- Seller Advantage – Better Tax Treatment: A stock purchase structure is generally a better tax result for sellers, especially where the purchase price is in cash. Any gain recognized in the transaction would normally be capital gain for federal tax purposes.

Disadvantages of a Stock Acquisition

- Buyer Disadvantage – Exposure to Unknown Risks: A buyer may be exposed to undisclosed or unforeseen liabilities of the target company.

- Shareholder Holdouts and Approvals: Obtaining approval if there are large number of target shareholders can be problematic. Holdout shareholders can cause problems.

- Buyer Disadvantage – Less Favorable Tax Treatment: Buyers may have less preferential tax treatment. This is because buyers may prefer to have a stepped-up cost basis in the target company’s assets than a stepped-up cost basis in the target company’s shares. This is unless they buyer can fall under a US Tax code exception (such as IRC section 338(h)(10) election).

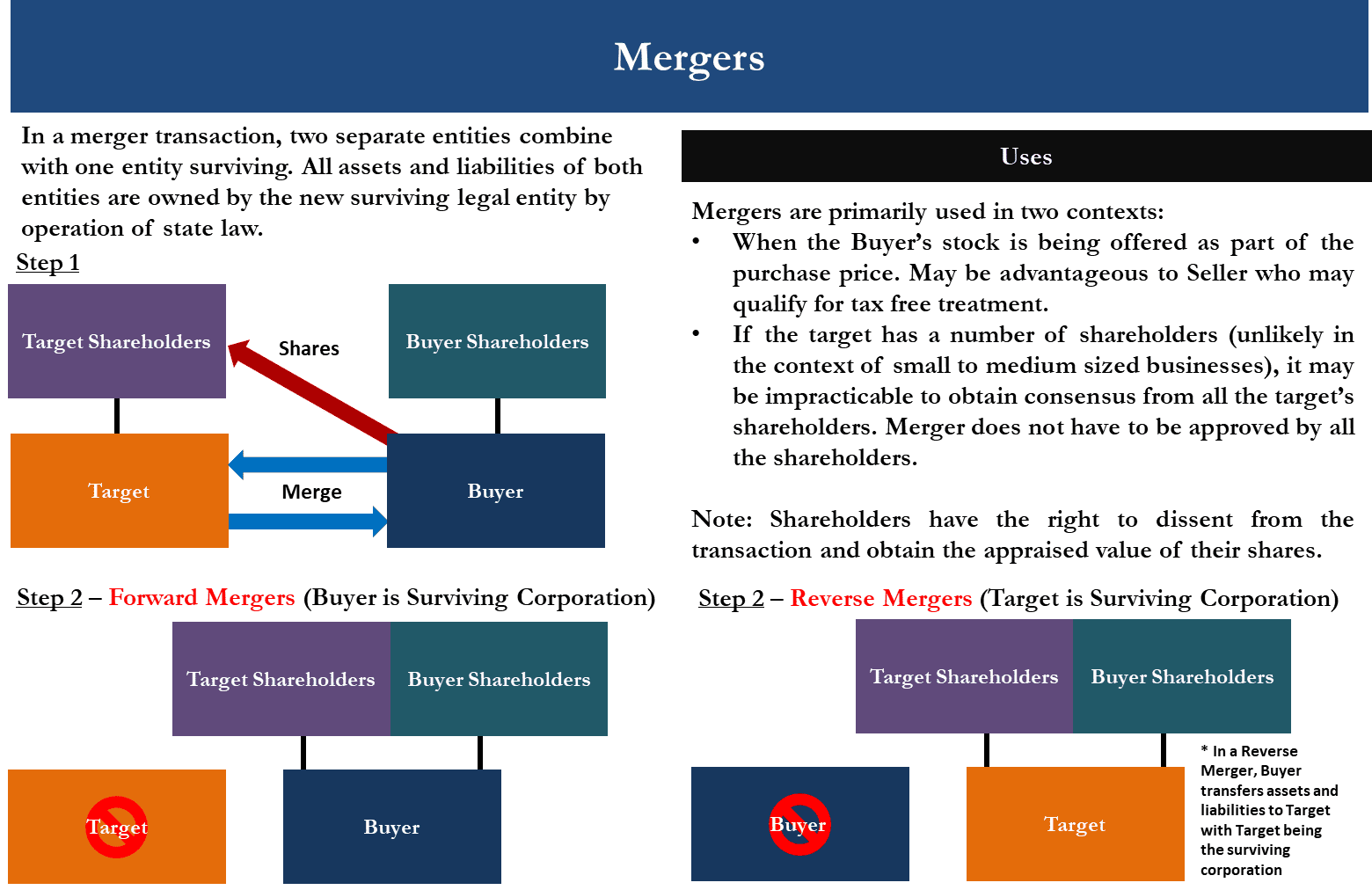

III. Merger

A merger is when two companies combine into one company. Every state will have legislation and case law to govern how the merger process will work. When two companies combine, one of these companies will “survive” the merger and continue to exist, while the other company will cease to exist. The surviving company will often be called the “surviving corporation,” while the other company will be referred to as the “disappearing corporation” or the “merged corporation.”

When two businesses agree to merge, a document is usually drafted called the “merger agreement” or “plan of merger.” This plan will tell the shareholders of each company what they will receive after the merger. Of course, the shareholders of the disappearing corporation must exchange their stock for something else such as cash, or shares in the surviving corporation because their company will no longer exist after the merger.

Once the merger is consummated, the surviving corporation will assume all the assets and liabilities of the disappearing corporation. In addition, the state law where the surviving corporation was incorporated will continue to govern the company after it merges. That said, if the two merging companies are incorporated in different states, each company must follow its own state law requirements before they are able to merge.

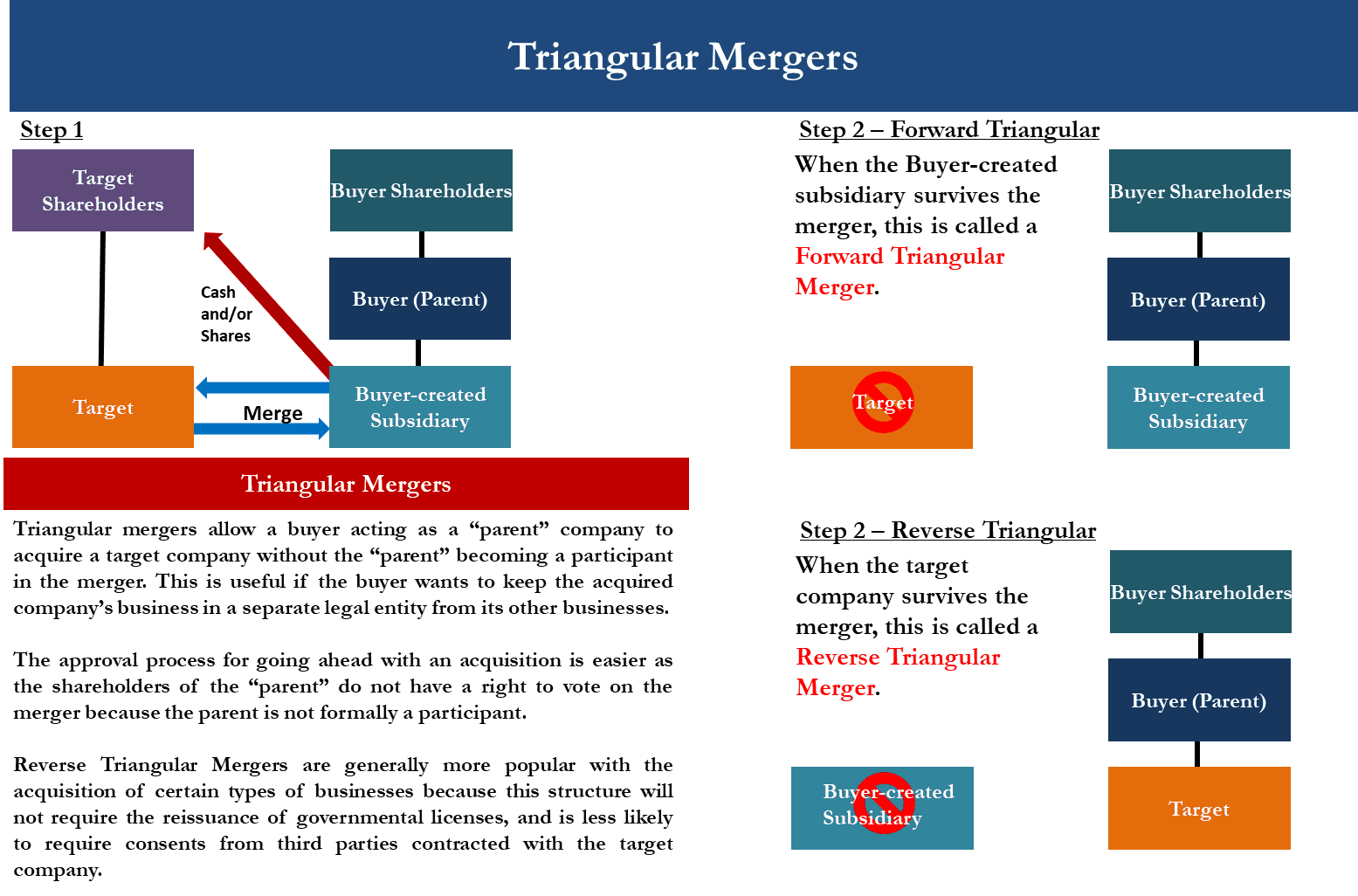

There are two basic merger structures: direct and indirect. In a direct merger, the target company and the buying company directly merge with each other. In an indirect merger, the target company will merge with a subsidiary company of the buyer. If the subsidiary of the buyer survives, this is called a “forward triangular merger.” If the target company survives, this is called a “reverse triangular merger.”

The best way to explain these concepts is through the use of diagrams as shown below.

Advantages of a Merger

Stock acquisitions are generally the preferred structure for sellers.

- Seller Advantage – Seller has No Contingent Liabilities: After the merger, the seller will not be left with any contingent liabilities.

- Only majority Consent Required: For most states (not all), only a majority consent of the target’s shareholders is required. This is a very effective way of getting the approvals to push forward the sale where a company has a large number of shareholders.

- Shareholder Appraisal Rights: This could be either an advantage or disadvantage. Shareholders have the right to dissent from the transaction and obtain an appraisal for the value of their shares.

- Buyer Advantage – Tax Free Treatment: If the target shareholders are receiving the buyer’s stock as part of the sale, this may be beneficial because the target shareholders may qualify for tax free treatment.

Disadvantages of a Merger

- Buyer Disadvantage – Cannot Pick and Choose, Must Assume All: A buyer cannot pick and choose specific assets and liabilities of the target company. It assumes all the liabilities – known and unknown.

- Third Party Consent: Numerous third party consents may be required if the target company is the disappearing corporation under the merger.

We hope you found this article helpful. Our firm believes in making quality information available online free of charge; and, in that vein, we’ve written on numerous related topics. We encourage you to visit our firm’s business resource page.